big-heart.ru

Tools

What Bank Is Best For Small Business Accounts

Here are the 10 best banks for small businesses in California, each spotlighting an economic region of the state, with links directly to the bank's websites. All your business checking account needs from cash flow management to more complex transactions—covered. Find out how Capital One business checking accounts. Chase and Bank of America are arguably the best choice for a small business. They both are considered too big too fail, offer new account promotions. Whether you are just starting your business or growing it, you'll find solutions that best fit your banking needs with Texas Capital. Checking; Savings; Money. Here are three of the top banks for small businesses where you can manage your business expenses and access other financial benefits. Explore Our Best Business Bank Accounts and Services ; Basic Business Checking. No monthly maintenance fees. Free domestic incoming wires. Explore Checking. Best banks for small business summary · Wells Fargo: Best for branch and ATM access · Bluevine: Best for business checking · Live Oak Bank: Best for business. After $20,, it's $ per $ deposited. Premium benefits to reward your banking relationship; Interest-bearing checking account. $25 minimum account. Compare the best small business bank accounts. We evaluated minimum balances, APYs, fees, and more. Expert-rated picks include Chase, Axos, and LendingClub. Here are the 10 best banks for small businesses in California, each spotlighting an economic region of the state, with links directly to the bank's websites. All your business checking account needs from cash flow management to more complex transactions—covered. Find out how Capital One business checking accounts. Chase and Bank of America are arguably the best choice for a small business. They both are considered too big too fail, offer new account promotions. Whether you are just starting your business or growing it, you'll find solutions that best fit your banking needs with Texas Capital. Checking; Savings; Money. Here are three of the top banks for small businesses where you can manage your business expenses and access other financial benefits. Explore Our Best Business Bank Accounts and Services ; Basic Business Checking. No monthly maintenance fees. Free domestic incoming wires. Explore Checking. Best banks for small business summary · Wells Fargo: Best for branch and ATM access · Bluevine: Best for business checking · Live Oak Bank: Best for business. After $20,, it's $ per $ deposited. Premium benefits to reward your banking relationship; Interest-bearing checking account. $25 minimum account. Compare the best small business bank accounts. We evaluated minimum balances, APYs, fees, and more. Expert-rated picks include Chase, Axos, and LendingClub.

To choose the best bank for your small business, you need to understand the strengths of community banks versus big banks, and you need to be clear on your. Check out this list of the best banks for small business, with less account fees and more perks to help your business grow. Typical bank accounts for a small business include: Checking account; Savings account; Merchant services account; Credit card account. Central Pacific Bank was founded in to serve the needs of all of Hawaii's families at a time when financial services were not available on an equitable. If you're a business owner looking for a modern banking solution that can keep up with your needs, I highly recommend giving Mercury Bank a try. When it comes to banking, size matters. However, that doesn't mean that bigger is always better. You'll need to evaluate your business's needs and your comfort. Welcome to Small Business Bank, home of FREE Business Checking. Open an account from anywhere in the US with no transaction limits and no minimum balance. Read on for our guide on the best banks for small businesses, as well as some money services business providers and credit unions. A small-business bank account is an account, usually checking, that supports day-to-day business operations. Having a separate business banking account ensures. Apply for a Business Checking Account online with First Internet Bank – because why not choose the best small business checking account? We combed through the terms of 16 top banks, assessing their usefulness to small businesses. There is no one “best” bank for all businesses. Simplify your small business banking and help your company grow with Bank of America Business Advantage. Open a business bank account, find credit cards. We'll focus on Chase Business Complete Checking as one of the best small business checking accounts since it has low monthly fees and powerful eBanking. Our picks for the best business checking accounts · Financial Resources Credit Union · Why we picked it · American Express National Bank · Why we picked it · Mercury. On the journey ahead, you can feel good knowing we're one of the best banks in Texas ready to meet your small business banking needs. I think you guys are the. Looking for the best business bank account. Options that ive researched are: Chase Business Banking - NOVO Business Banking (Online) - Mercury Business. Grow your money with a 6-month promotional interest rate of up to % when you open a business savings account with Capital One. When you partner with us. 2. Capital One Known mostly as a credit provider, Capital One is also the largest of the mostly “digital banking” options currently available, although it. 2. Capital One Known mostly as a credit provider, Capital One is also the largest of the mostly “digital banking” options currently available, although it. If you're looking for the best small business bank in North Carolina, the search ends with First Bank. First Bank's doors first opened in to serve.

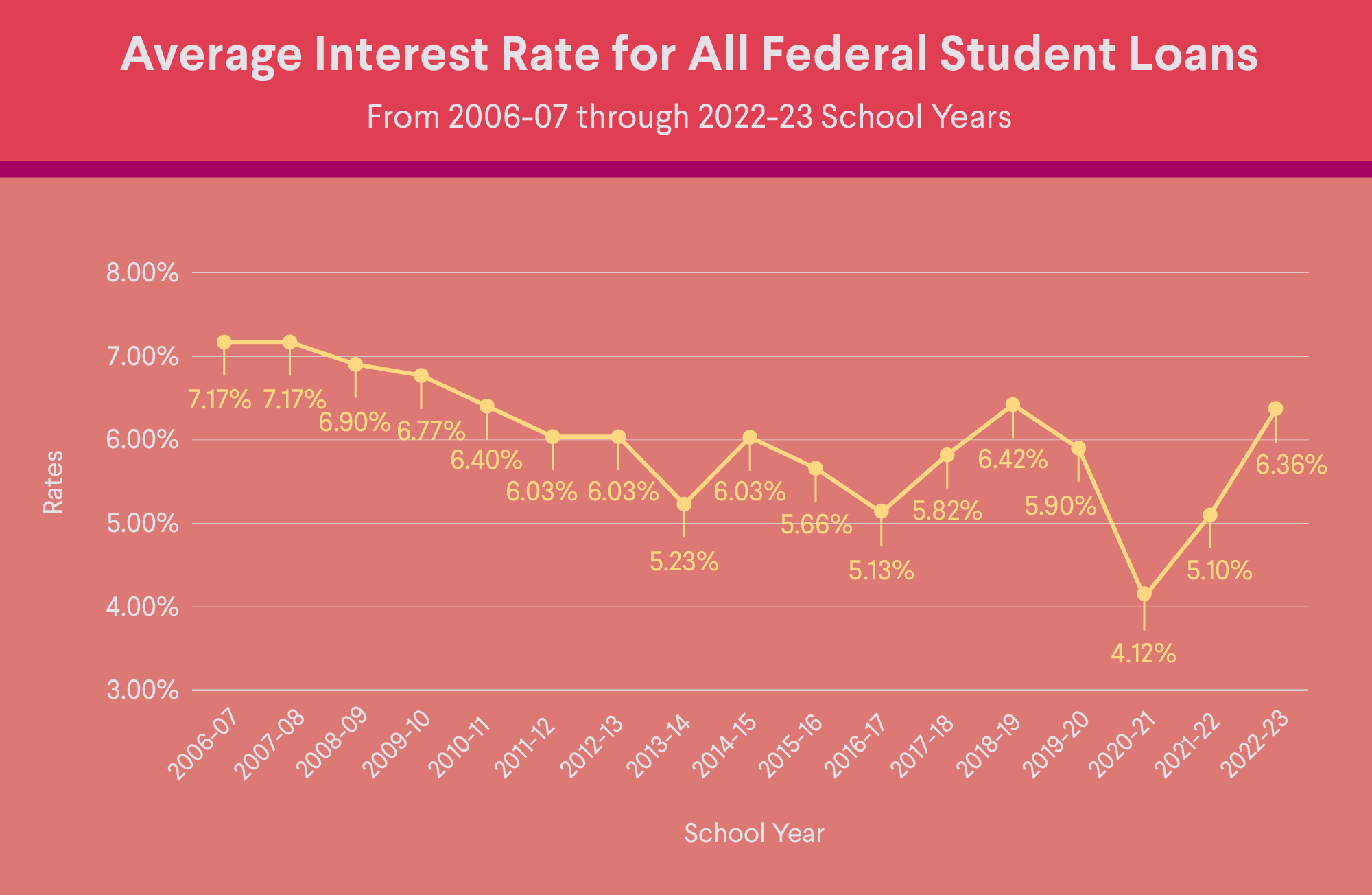

Current Federal Student Loan Interest Rates

Federal Graduate PLUS Loans ; Graduate PLUS, A graduate student enrolled at least half-time, % Fixed. PLUS LOANS - Parent and Graduate / Professional ; Fixed rate PLUS loan first disbursed on/after 7/1/06, n/a, % ; Variable rate PLUS first disbursed 7/1/98 - 6. Federal student loan interest rates · Direct subsidized (undergraduate students): % · Direct unsubsidized (undergraduate students): % · Direct subsidized . Interest rates for the award year for Unsubsidized loans is % and % for Grad PLUS loans. Unpaid interest may be capitalized only when the loan. Currently the interest rate is fixed at %. The government also charges fees to create the loan. The current percentage charged on an unsubsidized loan. –25 interest rates for Direct Loans disbursed on or after July 1, PreviousNext · Federal Student Aid. Private student loan rates typically range anywhere from around 4 percent to 18 percent. Your lender sets the interest rate you pay to borrow the funds. You. Current interest rate % for undergraduate students, % for graduate students. Based on year Treasury bond yield plus percent (for undergraduate. The interest rate on federal undergraduate loans will be %, the highest rate in at least a decade, according to higher education expert Mark Kantrowitz. Federal Graduate PLUS Loans ; Graduate PLUS, A graduate student enrolled at least half-time, % Fixed. PLUS LOANS - Parent and Graduate / Professional ; Fixed rate PLUS loan first disbursed on/after 7/1/06, n/a, % ; Variable rate PLUS first disbursed 7/1/98 - 6. Federal student loan interest rates · Direct subsidized (undergraduate students): % · Direct unsubsidized (undergraduate students): % · Direct subsidized . Interest rates for the award year for Unsubsidized loans is % and % for Grad PLUS loans. Unpaid interest may be capitalized only when the loan. Currently the interest rate is fixed at %. The government also charges fees to create the loan. The current percentage charged on an unsubsidized loan. –25 interest rates for Direct Loans disbursed on or after July 1, PreviousNext · Federal Student Aid. Private student loan rates typically range anywhere from around 4 percent to 18 percent. Your lender sets the interest rate you pay to borrow the funds. You. Current interest rate % for undergraduate students, % for graduate students. Based on year Treasury bond yield plus percent (for undergraduate. The interest rate on federal undergraduate loans will be %, the highest rate in at least a decade, according to higher education expert Mark Kantrowitz.

Direct Loans ; Undergraduate Students, %, %, % ; Graduate/ Professional Students, %, %, %. Federal Student Loan Interest Rates ; Direct Unsubsidized Loan (Undergraduate Students), %, % ; Direct Loan – Unsubsidized (Graduate/ Professional. You could consolidate your private and federal student loans to get a lower interest rate, pay off your loans faster or lower your monthly payment. Features. Undergraduate students ; Federal Direct Subsidized Undergraduate Stafford Loan ; Lender, Federal government ; Interest Rate, % – loans disbursed between 7/1/. Interest rates are % for new federal undergraduate loans, % for graduate loans, and % for parent PLUS loans. Private student loan interest rates. Ford Federal Direct Loans are used as part of this rate calculation. Cohort This loan requires good credit. See current student loan interest rates. The current federal student loan interest rate for undergraduates is %. · Graduate student and parent PLUS loans have fixed interest rates of % and %. As of July 1, , the current origination fee for unsubsidized loan is % and % for the Graduate/Professional Plus Loan. *NEW* Interest rates for. Private student loan rates: Historical trends · Direct Subsidized Loans and Direct Unsubsidized Loans (undergrads): % · Direct Unsubsidized Loans . The federal student loan interest rates are currently % for undergraduate loans, % for unsubsidized graduate loans and % for direct PLUS. Interest rates for fixed-rate undergraduate unsubsidized Federal Direct Loans ; 7/1/22 - 6/30/23, % ; 7/1/21 - 6/30/22, % ; 7/1/20 - 6/30/21, % ; 7/1/ The interest rate for unsubsidized Stafford loans made to graduate students is %. Rates are fixed for the life of the loan. (For more, see How Interest. Federal Loan Interest Rates by Year ; , %, % ; , %, % ; , %, % ; , %, % ; , %, %. Now you could get student loan refi rates starting at % variable APR with discounts when you open a Laurel Road Linked Checking® account and set up. For loans taken out for the - school year, undergraduate students receive a % interest rate and graduate students receive a % interest rate. Effective July · Subsidized and Unsubsidized Loans for undergraduate students. July to June %; July to June %; July to. Federal Direct Unsubsidized Student Loans will have a fixed interest rate of % for loans with a first disbursement date on or after July 1, The. The Department of Education announced that federal student loan interest rates are increasing to % for the school year on undergraduate loans. Federal law fixes student Direct Loan interest rates at percentage points above the year Treasury yield on notes sold to investors. Parent PLUS Loan.

Wall Street Prime Rate Today

WSJ US Prime Rate · · Advertisement · Advertisement · Search Results · Symbols · Private Companies · Recently Viewed Tickers · Authors. *APR= Annual percentage rate. Adjustable rate based on Wall Street Journal Prime plus %, currently at %. Minimum line amount is $10,, maximum. Fed Funds Rate (Current target rate ) Changes in the federal funds rate and the discount rate also dictate changes in The Wall Street Journal prime. The Wall Street Journal Prime Rate is an average of 10 large American banks' prime rates, which is published in WSJ on a regular basis. US prime rate is the base rate on corporate loans posted by at least 70% of the 10 largest US banks, and is effective 7/27/ The WSJ Prime Rate held steady at % from March until March , when the Fed bumped up the federal funds rate. The WSJ Prime Rate subsequently. The current Bank of America, NA prime rate is % (rate effective as of July 27, ). The prime rate is set by Bank of America based on various factors. The current prime rate among major US banks is %. The prime rate normally runs three percentage points above the central bank's federal funds rate. The current U.S. prime rate is %, having risen from % on July 27, To stay up to date with the current prime rate, visit The Wall Street Journal . WSJ US Prime Rate · · Advertisement · Advertisement · Search Results · Symbols · Private Companies · Recently Viewed Tickers · Authors. *APR= Annual percentage rate. Adjustable rate based on Wall Street Journal Prime plus %, currently at %. Minimum line amount is $10,, maximum. Fed Funds Rate (Current target rate ) Changes in the federal funds rate and the discount rate also dictate changes in The Wall Street Journal prime. The Wall Street Journal Prime Rate is an average of 10 large American banks' prime rates, which is published in WSJ on a regular basis. US prime rate is the base rate on corporate loans posted by at least 70% of the 10 largest US banks, and is effective 7/27/ The WSJ Prime Rate held steady at % from March until March , when the Fed bumped up the federal funds rate. The WSJ Prime Rate subsequently. The current Bank of America, NA prime rate is % (rate effective as of July 27, ). The prime rate is set by Bank of America based on various factors. The current prime rate among major US banks is %. The prime rate normally runs three percentage points above the central bank's federal funds rate. The current U.S. prime rate is %, having risen from % on July 27, To stay up to date with the current prime rate, visit The Wall Street Journal .

Also known as The Wall Street Journal prime rate or the U.S. Prime Rate Mortgages: If you currently have an adjustable-rate mortgage (ARM) that is tied. Rate posted by a majority of top 25 (by assets in domestic offices) insured US-chartered commercial banks. Prime is one of several base rates used by banks. Currently, the Federal Funds Rate is targeted at 0% %, making the prime rate for most banks %. Indeed, if you were to find a Wall Street Journal or. “Prime Rate” means, at any time, the rate of interest per annum then most recently published in The Wall Street Journal (or any successor publication if The. Historical Prime Rate ; · 7/27/, % ; · 12/16/, % ; · 6/29/, % ; · 2/3/, % ; · 11/15/ % – Effective as of: September 14, What is Prime Rate? The Prime Rate is the interest rate that banks use as a basis to set rates for different. WSJ Prime rate today is %. The rate and table below are updated daily and include the current WSJ Prime Rate, along with a number of other indexes. The WSJ Prime Rate is essentially the base interest rate that banks are charging borrowers, and it's referenced by lenders and borrowers alike. The prime rate is the current interest rate that financial institutions in the U.S. charge their best customers. The Wall Street Journal surveys the largest. The WSJP is approximately basis points (3%) above the federal funds rate, reflecting the Federal Reserve's monetary policy influences. It is often utilized. Historical data for the WSJ prime rate · Date of Change · (% - %) · - (%) · (% - %) · (% - %) · (% -. Graph and download economic data for Bank Prime Loan Rate (WPRIME) from to about prime, loans, interest rate, banks, interest. Prime Rate History target range for the fed funds rate at % - %. interest rates will be on September 18, New York City Rent Is Too High! One of the most used prime rates is the one that The Wall Street Journal publishes daily. Banks generally use fed funds + 3 to determine the current prime. WSJPRIME | A complete WSJ US Prime Rate interest rate overview by MarketWatch. View interest rate news and interest rate market information. You can find the current prime rate on the Wall Street Journal website. Why does the prime rate change? The Fed sets interest rate targets to manage the economy. Current Rates ; WSJ Prime, % ; SOFR day, % ; SOFR day, %. Publications may also refer to the Wall Street Journal Prime Lending Rate or the WSJ Prime Lending Rate. In addition to commercial loans and credit card rates. Also known as The Wall Street Journal prime rate or the U.S. Prime Rate Mortgages: If you currently have an adjustable-rate mortgage (ARM) that is tied. The Bloomberg Prime Rate will change as soon as 13 out of the Top 25 banks, based on Total Assets, change their prime rate.

The Best City To Live In Usa

New York therefore places 5th in the 'university rankings' category of the Best Student Cities index, just beating Boston, which is 6th. New York achieves the. NOLA Voted #4 Best City In The USA For the eighth year in a row, the readers of Travel + Leisure have named New Orleans a Top 10 City in America. For Outside of these places, I would list New York, Boston, DC, SF, LA, San Diego, Chicago, and Portland as all great cities to live in. IMO San. A recent Forbes article placed Jacksonville as the second best city to live in Florida, beating out Miami and Orlando on the top 10 list. Outside of these places, I would list New York, Boston, DC, SF, LA, San Diego, Chicago, and Portland as all great cities to live in. IMO San. The United States is a top consumer of natural resources across many By , 89% of the U.S. population and 68% of the world population is projected to live. New York City, NY. Population: 8,, · Los Angeles, CA. Population: 4,, · Chicago, IL. Population: 2,, · Houston. 2. Bainbridge Isl., WA, 5. Louisville, CO, 8. Peachtree City, GA ; 3. Naperville, IL, 6. Barrington, RI, 9. Chatham, NJ ; 4. Vienna, VA, 7. Middleton, WI, Gainesville came out as the top city, followed by Palm Coast and Fort Myers. These cities are generally home to low unemployment rates, great schools and low. New York therefore places 5th in the 'university rankings' category of the Best Student Cities index, just beating Boston, which is 6th. New York achieves the. NOLA Voted #4 Best City In The USA For the eighth year in a row, the readers of Travel + Leisure have named New Orleans a Top 10 City in America. For Outside of these places, I would list New York, Boston, DC, SF, LA, San Diego, Chicago, and Portland as all great cities to live in. IMO San. A recent Forbes article placed Jacksonville as the second best city to live in Florida, beating out Miami and Orlando on the top 10 list. Outside of these places, I would list New York, Boston, DC, SF, LA, San Diego, Chicago, and Portland as all great cities to live in. IMO San. The United States is a top consumer of natural resources across many By , 89% of the U.S. population and 68% of the world population is projected to live. New York City, NY. Population: 8,, · Los Angeles, CA. Population: 4,, · Chicago, IL. Population: 2,, · Houston. 2. Bainbridge Isl., WA, 5. Louisville, CO, 8. Peachtree City, GA ; 3. Naperville, IL, 6. Barrington, RI, 9. Chatham, NJ ; 4. Vienna, VA, 7. Middleton, WI, Gainesville came out as the top city, followed by Palm Coast and Fort Myers. These cities are generally home to low unemployment rates, great schools and low.

Weston ranked #30 by USA Today, after considering cities with populations over 65, in , the top performing city in each county was considered. 20 Best Cities to Live in the U.S. · Naples, Florida · Boise, Idaho · Colorado Springs, Colorado · Greenville, South Carolina · Charlotte, North Carolina. Best Places to Live in the U.S. in · Naples, FL · Boise, ID · Colorado Springs, CO · Greenville, SC · Charlotte, NC · Raleigh, NC · Huntsville, AL. #1 Best Cities to Live in America. Naperville · #2 Best Cities to Live in America. The Woodlands · #3 Best Cities to Live in America. Vancouver, Washington is a great place. Wa. has no income or estate tax. One can drive across the bridge to Portland, Oregon and enjoy the. 1. New York, New York · Los Angeles · 2. Los Angeles, California · Chicago · 3. Chicago, Illinois · Houston · 4. Houston, Texas · Phoenix · 5. Phoenix, Arizona. The United States is a top consumer of natural resources across many By , 89% of the U.S. population and 68% of the world population is projected to live. The 10 Most Expensive Cities to Live in the U.S. · Boston, Massachusetts · 9. Washington, District of Columbia · 8. Queens, New York · 7. Los Angeles. best states for retirement. For retirees looking to live in a big city on a small budget, Des Moines is a good choice. Affordability is just one reason the. Austin is the fourth largest city in Texas, after Houston, San Antonio and Dallas. More than 2 million people live in this bustling metro area. Austin attracts. Explore Our Best Places to Live in the U.S. · Carmel · Cary · Columbia · Fishers · Naperville · Broomfield · Overland Park · Sugar Land. Texas. LivScore: Best Places To Live by U.S. Region. Dreaming of moving out west? Wherever you're headed, start your journey here! Our five regional lists explore the top cities. Find the best places to live in America. Compare cost of living, population statistics, occupational outlook, school rankings, city guides and weather. New York City's Manhattan borough is the most costly place to live, followed by Honolulu, Hawaii, and San Jose, California. Housing and taxes contribute to the. Pittsburgh has recently been ranked among top cities in the US for friendliness, best cities, and most secure places to live to name just a few. Read. Explore Cities · Palm Springs, CA · Scottsdale, AZ · Panaca, NV · Wasilla, AK · Wappinger, NY · Amarillo, TX. New York City's Manhattan borough is the most costly place to live, followed by Honolulu, Hawaii, and San Jose, California. Housing and taxes contribute to the. Best places to live in the US · 1. Frisco · 2. Ann Arbor · 3. Huntsville · 4. Raleigh · 5. Fulshear · 6. Charleston · 7. Boise · 8. Fayetteville. Best Places to Live in United States · New York City · United States. {badge} New York City for a Digital Nomad · Dallas · United States. {badge} · Seattle. Why San Francisco is also considered one of the best cities in the US for higher education, is because of its reputed universities which rank among the top.

How To Negotiate The Best Price On A Used Car

Start off by stating an amount lower than what you're actually prepared to pay – you can then gradually increase it if necessary. When you make an offer, don't. How to Negotiate a Used Car Price · Conduct Your Own Market Research · Bargain for a Lower Price · Explore All of Our Resources to Help You Save. Do your online research first to identify the type of car you want and the price range you can expect. · Set your maximum price in advance and stick to it. · A. Ask for a Lower Price: If you're not satisfied with the initial asking price, how much can you negotiate on a used car? After a sales associate gives you the. If you can give me a better deal than this one (hand over a copy of the lowest sales price you've found, or a printout of a similar listing at a local. Begin by making an offer that is realistic but 15 to 25 percent lower than this figure. Name your offer and wait until the person you're negotiating with. One of the rules of friendly negotiation says once you as a buyer mention a price, you can't go any lower. Once they, as a seller, mention a price, they can't. Negotiating a Used Car Price · After the sales associate gives you the car's price, bring up your research. · Show the sales associate the lowest sales price you'. 5 tips for negotiating a car price · 1. Research the numbers · 2. Get preapproved financing · 3. Shop around for car loans · 4. Focus on the “out-the-door” price · 5. Start off by stating an amount lower than what you're actually prepared to pay – you can then gradually increase it if necessary. When you make an offer, don't. How to Negotiate a Used Car Price · Conduct Your Own Market Research · Bargain for a Lower Price · Explore All of Our Resources to Help You Save. Do your online research first to identify the type of car you want and the price range you can expect. · Set your maximum price in advance and stick to it. · A. Ask for a Lower Price: If you're not satisfied with the initial asking price, how much can you negotiate on a used car? After a sales associate gives you the. If you can give me a better deal than this one (hand over a copy of the lowest sales price you've found, or a printout of a similar listing at a local. Begin by making an offer that is realistic but 15 to 25 percent lower than this figure. Name your offer and wait until the person you're negotiating with. One of the rules of friendly negotiation says once you as a buyer mention a price, you can't go any lower. Once they, as a seller, mention a price, they can't. Negotiating a Used Car Price · After the sales associate gives you the car's price, bring up your research. · Show the sales associate the lowest sales price you'. 5 tips for negotiating a car price · 1. Research the numbers · 2. Get preapproved financing · 3. Shop around for car loans · 4. Focus on the “out-the-door” price · 5.

Make you offer at around 10% to 12% less than the asking price. Tell the seller you know the mark-up is around 15% and the wholesale price. Then stay quiet. Let. Begin by making an offer that is realistic but 15 to 25 percent lower than this figure. Name your offer and wait until the person you're negotiating with. More Tips on How to Negotiate a Used Car · Be prepared with facts and keep the conversation light but direct. · If you feel uncomfortable or pressured, simply. After doing your homework, you can use said homework to say why you believe a vehicle should be priced lower, citing how other vehicles have been priced in the. Find comparable cars in your area and note the prices. Find comparable cars outside your area and then add how much it would cost to get the car. More Tips on How to Negotiate a Used Car for Sale · Maintain a light but direct conversation while sticking to the facts of the car's price, condition, and. Ask for a Lower Price If you're finding that the market value is lower than the car you want to buy, you should ask for a lower price. This can be anxiety-. Tips on How to Negotiate a Used Car Price · Find out the market value of the vehicle you want to buy. You may want to know exactly how much a dealer will come. How to Negotiate a Used Car Price: Step by Step · Research Car Values · Know Your Budget · Ask for a Lower Price, if You Choose. Negotiating price on a used car is trickier than buying a new one. Each used vehicle is different in terms of condition and mileage, so you can't exactly. Set a Budget: You need to make sure that your used car purchase will fit with your budget. · Ask for a Lower Price: If you're not satisfied with the initial. You have to find out: Does the dealership have a non-negotiable, one-low-price policy? Are you buying a certified used car? Were others successful in getting a. Here are some tips on how to get the best used car price: Do your research. Before you begin negotiating, it's important to do your research. Research is your best friend — keep the conversation fact-based. · Take your time, especially when talking numbers. Make a note of how many cars you can afford. Research is your best friend — keep the conversation fact-based. · Take your time, especially when talking numbers. Make a note of how many cars you can afford. Let them know you are genuine and in the market. Tell them you have cash and are ready to buy. If you know a bit about this particular car, let. But as a car buyer, point out that you can just as easily buy the same make and model from somewhere else and save money. An experienced car salesperson will. When it comes to negotiating used car prices, research is key. Look up the specific model you're interested in on websites like big-heart.ru, Edmunds, and Kelley. Then go back to the other dealers and ask if they can beat it. Once you have the best price, you're ready to buy. Don't volunteer information. In negotiating. Negotiation Tactics · Start Low: Offer a price lower than your target to give room for negotiation. · Be Patient: Take your time and don't rush the process.

How To Make The Stock Market Make Money For You

There are two ways to make money from stocks. First, when the stock prices appreciate, you can sell it for a profit. The other way is through stocks that pay. You can use online tools such as IG's stock screener to find companies with a high dividend yield. Once you have identified a dividend stock, you can either. So before investing in stocks, do your research as they are risky. One day they go up high and the next you can crash on your face. Also keep in. There is no guarantee that you'll make money from your investments. financial security over the years and enjoy the benefits of managing your money. It's the power of compounding which helps you make money in the stock market. Even a little money of ten thousand rupees being invested in good companies. Investing does not automatically lead to wealth. Putting money in the stock market, for example, will not make you a millionaire, just as randomly tapping your. To trade stocks, you need to set clear investment goals, determine how much you can invest, decide how much risk you can tolerate, pick an account at a broker. Index funds are portfolios of stocks that follow the market as a whole. When you buy one share of an index fund, you are essentially buying. In a nutshell: Stocks can help companies and investors make money. For companies, money comes from the payments they receive when investors first buy their. There are two ways to make money from stocks. First, when the stock prices appreciate, you can sell it for a profit. The other way is through stocks that pay. You can use online tools such as IG's stock screener to find companies with a high dividend yield. Once you have identified a dividend stock, you can either. So before investing in stocks, do your research as they are risky. One day they go up high and the next you can crash on your face. Also keep in. There is no guarantee that you'll make money from your investments. financial security over the years and enjoy the benefits of managing your money. It's the power of compounding which helps you make money in the stock market. Even a little money of ten thousand rupees being invested in good companies. Investing does not automatically lead to wealth. Putting money in the stock market, for example, will not make you a millionaire, just as randomly tapping your. To trade stocks, you need to set clear investment goals, determine how much you can invest, decide how much risk you can tolerate, pick an account at a broker. Index funds are portfolios of stocks that follow the market as a whole. When you buy one share of an index fund, you are essentially buying. In a nutshell: Stocks can help companies and investors make money. For companies, money comes from the payments they receive when investors first buy their.

Recognising Your Trading Identity: · Avoid Being Like Everyone Else: · Timing: · Discipline: · Practical Goals: · Power of Capital Appreciation: · Taking Advantage of. Investing can be the smartest financial move you make. Although you might earn a steady paycheck from working, investing can put your hard-earned money to work. Investing does not automatically lead to wealth. Putting money in the stock market, for example, will not make you a millionaire, just as randomly tapping your. You should be aware that stock market investing is a beneficial activity if you want your money to increase. How to Make the Stock Market Make Money for You by Warren, Ted - ISBN - ISBN - Buccaneer Books - - Hardcover. You can use online tools such as IG's stock screener to find companies with a high dividend yield. Once you have identified a dividend stock, you can either. Free stock market game with real-time trading. Create a custom stock game for your class, club, or friends and learn to invest. Index funds are portfolios of stocks that follow the market as a whole. When you buy one share of an index fund, you are essentially buying. Many investors operate on the stock market to increase their money and make more through investment. However, just buying the stock and waiting for it to. Understand that stock market games are different from investing in real life. · Make sure you invest all, or almost all, of your computer money. · Look for stocks. Remember, fast profits in the stock market require a good understanding of its risks and strategies. If you liked this post, you'd LOVE my Ultimate Guide to. Only when you sell the stock you can lock in your gains. Since stock prices fluctuate constantly when the market is open, you never really know how much you. Sell high. You want to sell your stocks at their peak based on past history. If you sell the stocks for more money than you bought them for, you make. There are many other ways to put your money to work for you. Here are five ideas to help build wealth outside the stock market. Whether you play the general market or you trade penny stocks, ensure that you set stop-loss limits to cut any potential for significant depreciations. Now, if. So the two ways to make money with stocks are Dividends and Capital Gains. Investors should have a clear understanding of their strategy before purchasing stock. The reason to buy shares in a company is so you can profit from that company's performance. There are two ways your shares can make you money. Capital gains are. How Much Money Can You Make From Stocks? I have been trading for 17 years, and in my experience, beginners can expect to make 60% per year. And here's how to. A different way of looking at stock investment. This book provides a rare vie w about how to approach stock investment and get huge returns. And all this. Your approach to trading should be to get as professional as possible, and this means creating and sticking to systems. What systems did you have to put into.

Understanding How To Invest In Stocks

If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand before you invest that you could lose some or. Learn stock market basics and confidently start investing with our beginner-friendly guide to buying stocks. Start your investment journey today! A stock represents a share in the ownership of a company, including a claim on the company's earnings and assets. There are no account minimums to buy stocks in your Vanguard Brokerage Account. Learn more about settlement funds. Market timing is when you move your money in and out of equities to try and capture the performance highs and avoid the lows. It's extremely risky, and even the. Four reasons to invest in a company's stock · Electing board members · Deliberating on corporate actions and policies · Assessing the company's financial. Stock funds are offered by investment companies and can be purchased directly from them or through a broker or adviser. Understanding fees. Buying and selling. Step 1: Figure out what you're investing for · Step 2: Choose an account type · Step 3: Open the account and put money in it · Step 4: Pick investments · Step 5. Stocks are a popular form of investing these days. It helps to understand how to buy stocks before deciding whether or not investing in stocks is right for you. If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand before you invest that you could lose some or. Learn stock market basics and confidently start investing with our beginner-friendly guide to buying stocks. Start your investment journey today! A stock represents a share in the ownership of a company, including a claim on the company's earnings and assets. There are no account minimums to buy stocks in your Vanguard Brokerage Account. Learn more about settlement funds. Market timing is when you move your money in and out of equities to try and capture the performance highs and avoid the lows. It's extremely risky, and even the. Four reasons to invest in a company's stock · Electing board members · Deliberating on corporate actions and policies · Assessing the company's financial. Stock funds are offered by investment companies and can be purchased directly from them or through a broker or adviser. Understanding fees. Buying and selling. Step 1: Figure out what you're investing for · Step 2: Choose an account type · Step 3: Open the account and put money in it · Step 4: Pick investments · Step 5. Stocks are a popular form of investing these days. It helps to understand how to buy stocks before deciding whether or not investing in stocks is right for you.

If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand before you invest that you could lose some or. Using investing apps like Robinhood and Webull is a good first step. Both brokerages offer commission-free trading on stocks, options, ETFs and crypto, with no. There are no account minimums to buy stocks in your Vanguard Brokerage Account. Learn more about settlement funds. stocks, bonds, and other securities fluctuates with market conditions Understand the investment implications that come with a job change and. Diversify your portfolio. · Invest only in businesses you understand. · Avoid high-volatility stocks until you get the hang of investing. · Always avoid penny. Instead of trading shares based on stock market timing, investors buy stocks and hold onto them despite any market fluctuation. Active investing relies on real-. Investing is all about how willing you are to withstand the volatility of the market. The greater risk you take, the greater earnings you have the potential to. Using investing apps like Robinhood and Webull is a good first step. Both brokerages offer commission-free trading on stocks, options, ETFs and crypto, with no. What you'll learn · Have complete understanding and confidence when investing in the Stock Market. · Apply best practices and techniques to make better stock. It's important to know that there are risks when investing in the stock market. Like any investment, it helps to understand the risk/return relationship and. All investments carry some degree of risk. Stocks, bonds, mutual funds and exchange-traded funds can lose value—even their entire value—if market conditions. There are no account minimums to buy stocks in your Vanguard Brokerage Account. Learn more about settlement funds. An equity investment is money that is invested in a company by purchasing shares of that company in the stock market. Investing The tools you need to invest. Our guide to stocks, strategies, and everything in-between. All investments carry some degree of risk. Stocks, bonds, mutual funds and exchange-traded funds can lose value—even their entire value—if market conditions. It's important to know that there are risks when investing in the stock market. Like any investment, it helps to understand the risk/return relationship and. Stock trading for beginners involves considering your overall investment aims and your reasons for investing. Your risk-profile will dictate which types of. What you'll learn · Have complete understanding and confidence when investing in the Stock Market. · Apply best practices and techniques to make better stock. How to start investing in stocks · Open a basic brokerage account: As indicated, this is a simple and straightforward process that opens you up to myriad. Therefore, moderate portfolios would consist of an almost split between stocks and bonds. Your individual risk tolerance could be impacted by: Personal.

Mortgage Closing Statement Examples

.png)

Payoff of second mortgage loan. Payoff of first mortgage loan. I have carefully reviewed the HUD-1 Settlement Statement and to the best of. Closing Disclosure · Page 1: Information, loan terms, projected payments costs at closing · Page 2: Closing cost details including loan costs and other costs. The following examples illustrate preparation of several real estate closing statements. While not all-encompassing, they illustrate good closing procedures. A Closing Disclosure is a five (5) page form that provides final details about the terms of your mortgage loan. lender must also provide a closing disclosure statement outlining all closing fees. Mortgage Fallout: What It Is, How It Works, Example. Mortgage. Reserves deposited with lender. Hazard insurance. Mortgage insurance. City property taxes. Sample HUD Closing Statement. A. U.S. DEPARTMENT OF HOUSING AND URBAN Payoff of first mortgage loan. Payoff of second mortgage. Sample Closing Disclosure Viewing page: Details to check Ask the lender to correct any inaccurate contact information. Even minor misspellings can cause. Mortgage Assumption fee. $. $. Mortgage Prepayment Penalty. $. $. Mortgage Loan Fee. $. $. Points. $. $. Discount Points (>1 pd by Seller). $. $. Payoff of second mortgage loan. Payoff of first mortgage loan. I have carefully reviewed the HUD-1 Settlement Statement and to the best of. Closing Disclosure · Page 1: Information, loan terms, projected payments costs at closing · Page 2: Closing cost details including loan costs and other costs. The following examples illustrate preparation of several real estate closing statements. While not all-encompassing, they illustrate good closing procedures. A Closing Disclosure is a five (5) page form that provides final details about the terms of your mortgage loan. lender must also provide a closing disclosure statement outlining all closing fees. Mortgage Fallout: What It Is, How It Works, Example. Mortgage. Reserves deposited with lender. Hazard insurance. Mortgage insurance. City property taxes. Sample HUD Closing Statement. A. U.S. DEPARTMENT OF HOUSING AND URBAN Payoff of first mortgage loan. Payoff of second mortgage. Sample Closing Disclosure Viewing page: Details to check Ask the lender to correct any inaccurate contact information. Even minor misspellings can cause. Mortgage Assumption fee. $. $. Mortgage Prepayment Penalty. $. $. Mortgage Loan Fee. $. $. Points. $. $. Discount Points (>1 pd by Seller). $. $.

The Most Important Documents in your Closing - Statement of Adjustments and Trust Ledger Statement. closing (after a mortgage is paid off, for example). Define Loan Closing Statement. means that certain [Loan Closing Statement and Disbursement Instructions] dated as of the Closing Date, executed by Xxxxxxxx. The Closing Statements · The Mortgage Note · The Mortgage Deed · Riders to the Mortgage Deed · The Residential Loan Application (FNMA ) · The Housing Payment. HUD-1 Settlement Statement; Truth in Lending (TILA) Statement; Mortgage Note; Mortgage or Deed of Trust; Certificate of Occupancy. Here are some sample. This form is furnished to give you a statement of actual settlement costs. Amounts paid to and by the settlement agent are shown. Items marked. Specify any prorations or adjustments that need to be made. For example, if the property taxes or homeowner's insurance were prepaid by the seller, these. The real estate closing statement is a vital part of the home buying process. For example, if a buyer has put down a good faith deposit to hold the. A real estate closing statement is a document that summarizes all of the fees and expenses associated with the purchase or sale of a piece of real estate. Settlement Charges to Seller – Seller's total charges; carried from page 2, line Existing Loan(s) Taken Subject to – On assumptions or wrap loans. Buyer Settlement Statement that included buyer loan related closing fees; Seller Settlement Statement that includes seller related closing fees; Cash Settlement. LOAN NUMBER: SETTLEMENT STATEMENT. 8. MORTGAGE INS CASE NUMBER: C. NOTE: This form is furnished to give you a statement of actual settlement costs. Amounts. State of Illinois Policy Fee: Home Warranty to: Earnest Money held by: Payoff on Sellers prior Mortgage(s). 1. 2. Express Delivery Fee: Recording Fee. Examples of closing costs include fees related to the origination and underwriting of a mortgage, real estate commissions, taxes, insurance, and record filing. YOUR CLOSING STATEMENT IS "IMPORTANT": When your escrow has closed you will receive a closing statement which is a summary of the costs and financial settlement. Find predesigned Mortgage Closing Statement Examples Ppt Pictures Example Topics Cpb PowerPoint templates slides, graphics, and image designs provided by. Closing Statement Examples · Example 1: The mortgage-based closing statement · Example 2: The seller-specific closing statement · Example 3: The loan-specific. Mortgage Payoff, The payoff amount is sent to the existing mortgage company and includes additional interest a few days beyond closing. ; Title Insurance . Closing Statements. The legal forms provided herein are intended for use by attorneys only. New York Title, Abstract Services Inc. assumes no liability. The buyer's down payment and mortgage amount to pay both the seller and closing costs are at the top of the Trust Ledger. The amount that is owed to the seller. An initial escrow statement outlines the payments on taxes and insurance that will come from your escrow account during the first year of your mortgage. Your.

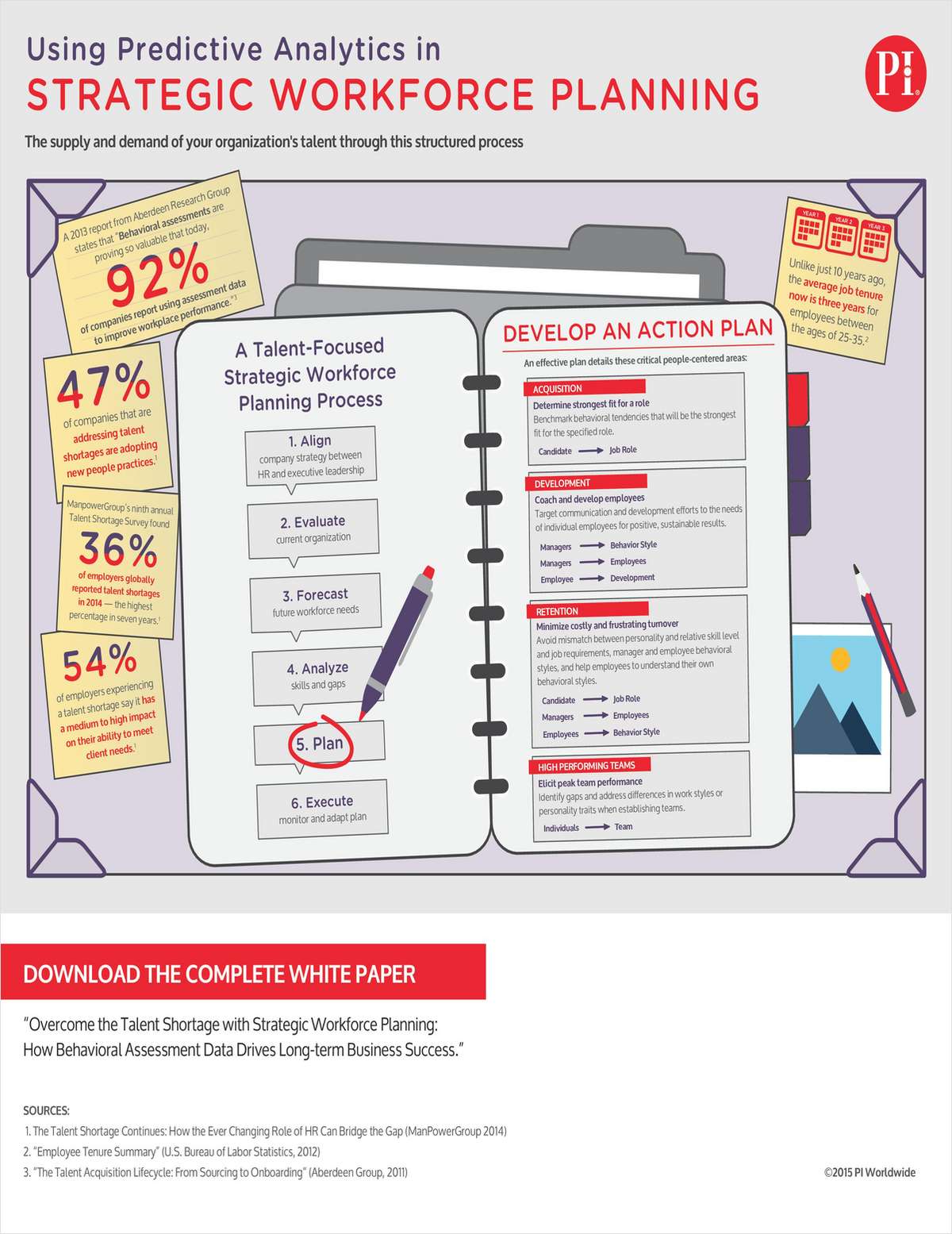

Predictive Workforce Monitoring

Employee monitoring helps with work-life balance, too. Technology Management Plus, algorithms for automation provide predictive analytics and. The Volkswagen logo. Volkswagen Japan streamlines device management with predictive analytics. Read. Using deep data insights can resolve downtime and issues. Predictive workforce planning involves leveraging data analytics and algorithms to forecast future talent needs and make informed decisions. To thrive in today's world, your workforce and business must be able to adapt quickly. Uncover powerful insights with workforce analytics and planning to. Beyond predicting turnover and engagement, workforce analytics also provides advanced metrics for tracking team performance and identifying. Monitor service levels, occupancy and adherence in real time. Enhance time-off management and use work plan bidding to balance employee preferences with. Predictive analytics harnesses the power of data, statistical algorithms, and machine learning techniques to predict future outcomes based on historical data. forecasting to tracking employee time and complying with regulations. Advanced analytics and AI capabilities are crucial for predictive insights and. Predictive HR analytics is used to analyze historical data to make predictions about the future. It shouldn't be confused with standard HR analytics. Employee monitoring helps with work-life balance, too. Technology Management Plus, algorithms for automation provide predictive analytics and. The Volkswagen logo. Volkswagen Japan streamlines device management with predictive analytics. Read. Using deep data insights can resolve downtime and issues. Predictive workforce planning involves leveraging data analytics and algorithms to forecast future talent needs and make informed decisions. To thrive in today's world, your workforce and business must be able to adapt quickly. Uncover powerful insights with workforce analytics and planning to. Beyond predicting turnover and engagement, workforce analytics also provides advanced metrics for tracking team performance and identifying. Monitor service levels, occupancy and adherence in real time. Enhance time-off management and use work plan bidding to balance employee preferences with. Predictive analytics harnesses the power of data, statistical algorithms, and machine learning techniques to predict future outcomes based on historical data. forecasting to tracking employee time and complying with regulations. Advanced analytics and AI capabilities are crucial for predictive insights and. Predictive HR analytics is used to analyze historical data to make predictions about the future. It shouldn't be confused with standard HR analytics.

Get the only validated solutions that can quickly & accurately predict fatigue and track alertness for a safer, more productive workforce. Predictive and Prescriptive Analysis: Use historical data to make statistically-based predictions about future workforce trends. Based on predictions and. Employee monitoring software is an essential tool for businesses that want to verify that employees are using their time at work to accomplish the. Unlock the full potential of your people with Calabrio WFM. Our contact center workforce management software delivers AI forecasting, self-scheduling. Monitor productivity, track time, manage remote teams, and much more with Insightful - the best workforce analytics software! Analyze The Digital Workplace. SEE AND Predictive monitoring and proactive alerts to get ahead of digital employee experience disrupting problems. Real-time predictive analytics, equipment models and easy-to-use dashboards work together to show current building performance, identify improvements. Improve workforce planning and forecasting. •. Shorten recruiting cycles By monitoring, measuring, and publicizing results, confidence can be built. Predictive models can analyze employee data, such as performance reviews Workforce planning. Predictive analytics can forecast future skill gaps. workforce engagement, efficiency and operational improvements. Copyright © Genesys. All rights Reserved. Terms of Use | Privacy Policy | Email. While predictive workforce planning focuses on the future, it uses retrospective data as a base to provide management with predictive information that can. workforce – from budgeting, scheduling, and forecasting to tracking employee time and complying with regulations. Explore WFM software. The evolution of. But the game is changing quickly. A growing number of executive teams are adopting advanced analytical techniques, such as predictive modeling, to move into a. The use of predictive analytics can also help recruiters identify weak points in their hiring cycle. As a result, companies can improve the candidate experience. But the game is changing quickly. A growing number of executive teams are adopting advanced analytical techniques, such as predictive modeling, to move into a. Talent management and predictive workforce big-heart.ru - 1. Talent Management and predictive workforce management Talent management Talent management. It includes many things, like predictive monitoring and predictive maintenance. You might need some education sessions before your workforce is ready for this. Enhance channel-specific planning accuracy with AI-powered forecasting engine. AI-led Forecasting. Capacity Planning. Staffing Simulation. Real-time Agent. Using workforce analytics to monitor employee digital activity is a great predictive analytics uses that information to create an employee burnout model. talent management and development. B. predictive workforce monitoring. C. strategic personnel planning. D. external labor forecasting. Workforce: In a company.